Buying silver

2023-04-15Updated 2023-06-17, more info

By Green Snake

Introduction

This blog entry will give a brief talk about silver, what money is, and buying physical silver.

What is silver?

Silver is a rare, shiny silver-colored metal. Its atomic number is 47 with the symbol AG.

Of the 1,740,000 metric tons of silver discovered to date, 55% is found in just four countries on earth. All the silver discovered thus far would fit in a cube 55 meters (180 ft or 60 yards) on a side.

- usgs.gov(govt link)

Sterling silver is 92.5% silver and the 7.5% remainder is copper or some other metal.

Silver is normally coined in "one troy ounce."(wiki)This is equal to 31.1034768 grams. A Troy Ounce is an old measuring metric from 15th century England used mainly for precious metals. A Standard Ounce is different from a Troy Ounce. A standard ounce is 28.349 grams.

The other precious metals are Gold, Platinum, Palladium, Rhodium, Copper, etc.(prices)

In 2019, U.S. mines produced approximately 980 tons of silver with an estimated value of $510 million - usgs.gov(govt link)

According to that same report, in 2019, global mines produced ~27,000 tons of silver.

Uses of Silver

Silver is used: as money, tableware, worn as jewelry, and has various industrial usages. Industrial uses such as electronics, medical, chemical, etc. It also has anti-microbial properties.

The rising price of platinum, rhodium, and platinum caused a rise of catalytic converters theft (aka cats). These are on the bottom of cars required to clean-up emissions. The crime can quickly take place with multiple, trained criminals.

Catalytic converter theft is on the rise nationwide, new data shows. In 2022, thefts nationwide were 540% higher than all of 2020, public data company BeenVerified found. Over the last three years, catalytic converter thefts have soared nearly 2,200%, the latest figures from BeenVerified show.(link)

I imagine when the price of precious metals goes up further, people will go dig for gold in old electronics at the local landfill.

What is Money

Before money, people use to trade through barter. For example: Alice has only apples. Bob has some lemons. Alice wants some lemons. Bob wants some apples. The two come together and agree to trade apples and limes. Both agree to the quantity and quality and come to a mutually beneficial agreement and trade. Both sides end up better off. The price is set by supply and demand. If limes were extremely rare, Alice would probably need to trade 100 apples for 1 lime.

But what if Bob doesn't want common apples? Alice can trade her apples for something that is more desirable. In this imaginary economy, let's say it's dried fish. So she trades her apples for dried fish. She is then able to get some limes by trading the dried fish. In this case, the dried fish was a "medium of exchange."

Over time, people find certain things easier to hold and trade than a bunch of moldy apples. Throughout many civilizations across the planet, across time, people have chosen gold and silver. From the Ancient Aztecs, to Ancient Japan, to Ancient Egypt, etc. People love the rare, shiny metal.

The common characteristics of money is: durability, portability, divisibility, uniformity, limited supply, and acceptability. Gold and silver clearly have these properties.

Money is just a concept. In prison, people use ramen and cigarettes as money. People agree to these things naturally.(npr: ramen as money)

In the game, Diablo 2, their default money (gold) experienced hyperinflation. Players used a ring called "Stone of Jordan" to facilitate trade.(fandom, diablo)

(wiki: silver standard)

The Money Scheme

You may not give much thought to gold and silver as money. Why? If you go to government funded schools, they generally frown upon gold and silver as money. Many governments used to use the precious metals as money, and many governments would be irritated at the constraint imposed by the metals. Governments would want to spend more. The metals are a link to reality. You cannot create more gold and silver. Only dig it up, and quite slowly.

Governments may have a desire to expand like cancer. Such is the nature of bureaucracy. In some cases, the governments create the problem or encourage it. Then they come in and provide solutions that ultimately implode. Today, you can look at the US government, the massive amount of debt, the massive deficit, the expenditures, and the interest payments. These financially negative trends has been continuing for well over a century. It will not end well.

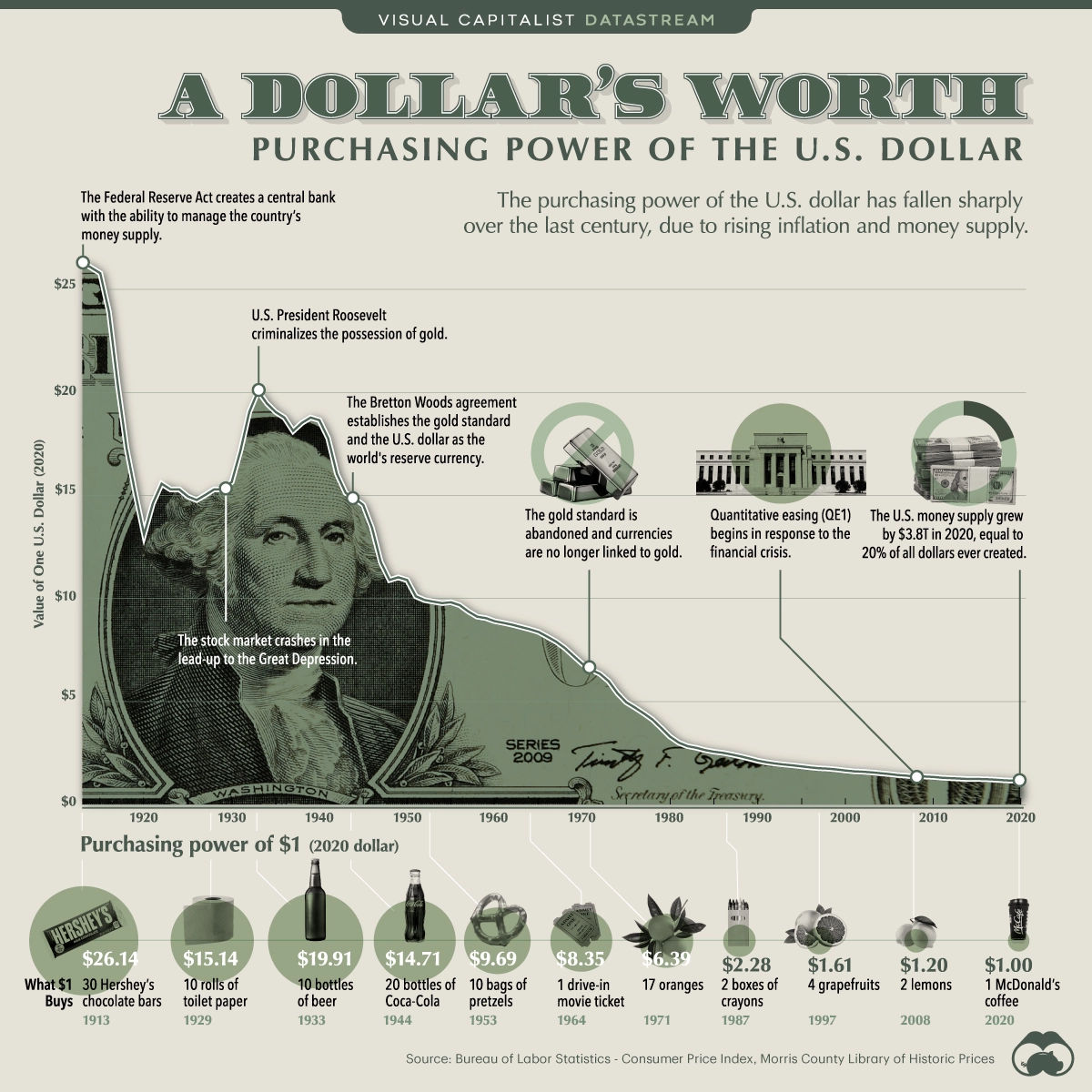

Governments would corrupt the money supply with their schemes until the money becomes worthless. The Ancient Romans used to use precious metals. The Roman government had great ambitions immediately, but was limited by financial reality. They had a scheme to take existing coins and reissue them at 50% silver. They doubled their spending ability. Over time, the government kept diluting the silver purity of the coins. And over time, the government was flooding the markets with cheap bronze. This was reflected in high prices (priced in the worthless money). Of course, if we were to do this, we'd be put in a cage.(Visual Capitalist Roman Money Visualization)

Another scheme is to link the physical metals to paper receipts. You can redeem the paper for physical metals. It is more convenient to carry the paper than heavy metals, so that's what people used. Governments realized that they can print more paper (without increasing the metals supply), thus increasing their own spending power. Like Ancient Rome, this fraudulent scheme causes prices (denominated in the paper money) to rise.

US Money

During the colonial times (1770s), the US government issued the "Continental Dollars" which was printed into oblivion.(wiki: Continental)

The US used to have silver certificates which you can trade for physical silver (It says so on the note). The US used to use silver quarters until they stoppped in 1965. Now, it's just cheap metals. Today, the spot price of silver is about $25. So a silver quarter (0.1808 troy ounces of silver.) is ~$4.52 (and some premium).(wiki: silver certificate)

You can buy some expensive certificates at Apmex for fun. I don't think the government will honor these.(apmex: Buy US Certificates)

President Nixon declared that the US will no longer use gold in 1971, thus delinking the US dollar to gold.(wiki: Nixon Shock, End of Bretton Woods Agreement)Before that, many nations were linked to the US dollar, which was linked to gold.(Investopedia: Bretton Woods Agreement)

Instead of certificates, we have Federal Reserve Notes, which is redeemable in more Federal Reserve notes.

Today, I suspect many younger generations have never seen a silver quarter or know of their existence.

Hyperinflation Nation

Here is a small list of countries that experienced hyperinflation. Today, every nation uses no commodity currency or money. It is 100% paper backed by paper. There may be talks now from the nation of the BRICS alliance to form a gold-backed currency.(SchiffGold: BRICS gold)

- Ancient Rome(Visual Capitalist)

- China(Hubu Guanpiao)

- Hungary(Hungarian Pengo)

- Venezuela(My blog about Venezuelan Hyperinflation)

- Post WW1 Germany(Weimar Republic hyperinflation)

- Zimbabwe. Their currency is so worthless that they have significant novelty value now. Today (July 2023), the 100-trillion note is ~$70.(wiki)

- Argentina

The True Source of Inflation

In a normal scenario, prices are naturally set by many people for anything. We can get prices for complex pieces of machinery such as graphics cards, yachts, and even islands. Don't get me started with the medical industry and their distorted pricing mechanisms. It's a rat nest of laws, regulations, insurance companies, Medicare, Medicaid, special interests, etc.(gothamist)

To combat rising prices, governments often implement price controls (see my inflationary blog series). The government believes that people are "price gouging" but no. The higher prices are a result of a currency that have been printed into oblivion. Existing currency is diluted and worth less.

With price controls, this will cause shortages. If you have something in extreme demand, you're not going to give it away for a dollar. In Venezuela, people really needed food, but with price controls, it caused shortages. So people had to go to "black markets" to buy food at high prices (the actual real price).

Governments may blame "price gougers" but will never blame their own money printers or policies which cause the shortages.

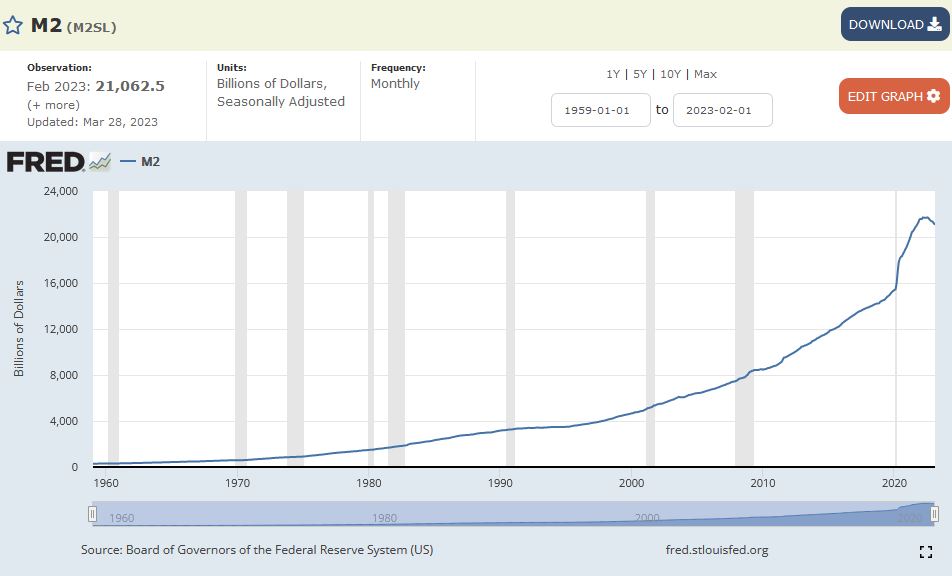

The US government gave over the power of (funny) money creation to a separate entity called "The Federal Reserve Bank." This bank continues to print the dollar into oblivion thus diluting all existing dollars. Look at how much funny money has been created recently.Federal Reserve M2 Money supply

Side note: Insulin

Such a conspiracy does exist among insulin. Insulin is a drug that is used by diabetics to regulate their blood sugar levels and not die. The cost of making insulin is actually pretty cheap. Insulin was made a long time ago and the patent almost expired. If it becomes out-of-patent, then many people can produce it for cheap. But by playing the patent laws, a small handful of companies are able to monopolize and price gouge.(nbc news)

Why buy silver

If you keep your dollars, you'll find that the prices for everything rises. This is the effect of the decreasing purchasing power of modern money. To combat this, you can trade your devaluing dollars with literally anything that isn't being printed towards Zimbabwe-levels of hyperinflation. Such as: furniture, bags of sugar, beanie babies, silver coins, etc. You'll notice the price of precious metals goes up when everyone is economically afraid or when the government prints more funny money. Gold is sometimes known as the "fear index." In terms of price, gold is less volatile than silver.

Another fantastic reason to buy silver, and my personal favorite, is the "to the moon" levels of speculation. You saw what happened with the Gamestop stock and the questionable hedge funds that borrowed over 100% of shares availabe for shorting? People suspect that something similiar is happening for silver, but on a bigger scale. Instead of buying and holding shares, you buy and hold physical silver. The key seems to be the COMEX's silver vault, which is why I developed that chart.(Comex silver chart)

There are plenty of conspiracy theories on the reddit silver forums. One such incident of interest is JPMC being fined nearly a billion dollars for some metals manipulation.(cnbc)An explanation of the COMEX manipulation by Andrew Maguire.(source: youtube, Arcadia Economics)

The Hunt Brothers attempted to corner the physical market, thus causing the price of silver to explode in the March 1980. They didn't succeed.(wiki: hunt brothers)

The amount of silver in existence is estimated to be 3 billion.(source: gainesvillecoins)As of now (2023-06), the number of people on earth is ~8 billion.(source: worldometers)So if we divide the silver equally, every person on the planet would have 0.375 troy ozs of silver.

The gold silver ratio has been 12 - 15 since ancient times. Only within recent history has this ratio been changed. Today, it is ~80. People believe that the price of silver has to go up (due to inflation) to match this.(source: investopedia.com, gold/silver ratio)(source: goldsilver.com, gold/silver ratio)

I should note that this is an inert shiny rock. It just sits there. No dividends. Silver prices have been hovering between $20 and $30 for 10 years. Even with rampant inflation, how strange! It's almost like there's some invisible force suppressing the price of silver. Hmm... 🤔

If you ask someone on a silver forums, they'll tell you to buy a lot 😎.

How to buy silver

You can buy either paper silver or physical silver. For paper silver, you can buy exchange-traded-funds (ETF) such as SLV and PSLV. Paper silver is not as good as the actual thing. If there happens to be some surprise scenario such as fraud, the paper can disappear. Also, if you want the physical delivery, you may find difficulty, such as people trying to claim delivery off the COMEX. A friend mentioned to me that PSLV's largest private shareholder is BlackRock. That could be good or bad?(fintel: institutional shareholders)

(bags of nickel were actually rocks)

There are also mining stocks, which has their risk (and reward).

Physical silver can be bought through offline or reputable online coin stores. You can also buy from the US Mint, but you may find difficulty. You can also buy from ebay, but there are reports of fakes, so please beware. Here are some places I like buying from:

There is a disconnect between paper and physical silver price, which is why I made the silver metrics page. (silver metrics)When I say paper price, I mean the "spot price." This is the live global price.(Investopedia: Spot price)(Kitco: Live Spot price)

People be aware of various US state taxes. You can legally ship to another state to a trusted friend or family. Then you have them ship it to you.(source: apmex.com, taxes)

What physical silver to buy

There are a lot of choices. Coins (government money), rounds (not government money), bars, by weight (remember, troy ounces, not standard ounces). Then there is the odd stuff: Misprints, historical, numismatics, commemorative, merchandise (john wick), special shapes (cubes, lego, spheres, pickle rick, shark, micro, cat shaped, statues). There are pros and cons to each option.

If you hear the term "bullion," that is a common term for high-purity coin, bar, etc.

Government coins are more recognizable by people. They have standardized measurements, weights, and designs. They even slowly go up in value due to historical age. These can even be used in the store since they have a denomination such as $5. The value of the metal makes this fact pointless. Premiums are generally higher. American Silver Eagles have exploded in price recently making it a less viable play for most people. There is "junk/constitional silver" which is "older US money". Coins before 1965 have silver. This is good for easy trading.

Silver rounds are less recognizable by people. Some are produced by specific popular mints or places such as Apmex.com. They don't go up in value due to historical age. Premiums are generally lower. A solid buy.

The bigger the silver size, the lower the premium. Bigger objects may be easier to fake. You get a discount when you pay in cash or e-check. A big block of silver is heavy and harder to trade with (liquidate). The smaller the silver size, the higher the premium.

There are also coin grades based on coin quality. Higher grades are more expensive. You can just get tarnished or culled silver because silver is silver. But some people may prefer shiny stuff. I normally like "brilliant uncirculated" (BU). Some coins are "proof" which are fancy display coins.(wiki: coin grading)

Historical numismatic coins are cool but they cost an extreme amount over spot. I don't recommend this.

Some coins are fun to look at and I enjoy owning a couple of them. They may involve: An animal, country, movie, person, event, place, strange design, etc.

I normally buy silver snakes from moneymetals.com or apmex rounds from apmex.com. I normally buy a few dollars over spot.

(moneymetals.com, snake coin, 1 oz)

(apmex.com, list of silver rounds)

(apmex.com, apmex silver round, 1 oz)

How to test silver

Silver can be tested in a variety of ways.

- Phone apps that can test the ping a coin makes when you strike it.

- Verify Weight

- Verify Measurements

- Strong magnet test - Silver is only partly magnetic. Tilting the coin will cause the magnet to slowly fall off.

- Use an expensive Sigma Metalytics detector

- Nitric Acid test (may damage coin)

- Examine visual coin features. (maybe the font is off)

- Cut coin in half

Silver does tarnish and becomes grayer with exposure to air. You can keep your coins in plastic capsules. Some get "milk spots." Silver Canadian Maple Leaf coins are prone to this problem.

How to take care of silver

I don't recommend cleaning coins as it may damage the coin.

If you deposit your coins somewhere remote, please be aware of thieves. This includes the people running the place.

How to sell

You don't. 🤡

But if you have to make payments on your pizza, you can sell your silver to anyone who has an interest in silver at around or above spot price. Or you can go to your local coin dealer and sell it for some amount below spot.

Reading Materials

Here is some food for thought.

- My silver metrics(silverbacksnakes.io)

- My gold metrics(silverbacksnakes.io)

- Silverwars.com, current news on silver

- "Guide to Investing in Gold & Silver: Protect your Financial Future" by Michael Maloney(amazon)

- "The Coming Currency Collapse" by Jerome F. Smith. An old book on the subject of hyperinflation.(amazon)

- "The Big Silver Short" by Chris Marcus. Various viewpoints on silver investing.(amazon)

- Michael Maloney's youtube, a pro-gold investor

- Peter Schiff's youtube, another pro-gold investor

- Wiki: Hyperinflation

- Reddit: Silver Degen Club, a wacky silver forum

- Reddit: Wall Street Silver, another wacky silver forum

Changlog

- 2025-03-15, added more reading materials.