Why I built this website

2022-10-02By Green Snake

Inflation and Rocks

If you read about the economy, you'll read about monetary policy. Then you'll read about inflation. And then you'll read about gold and silver. I personally enjoy owning and staring at my pile of shiny silver rocks.

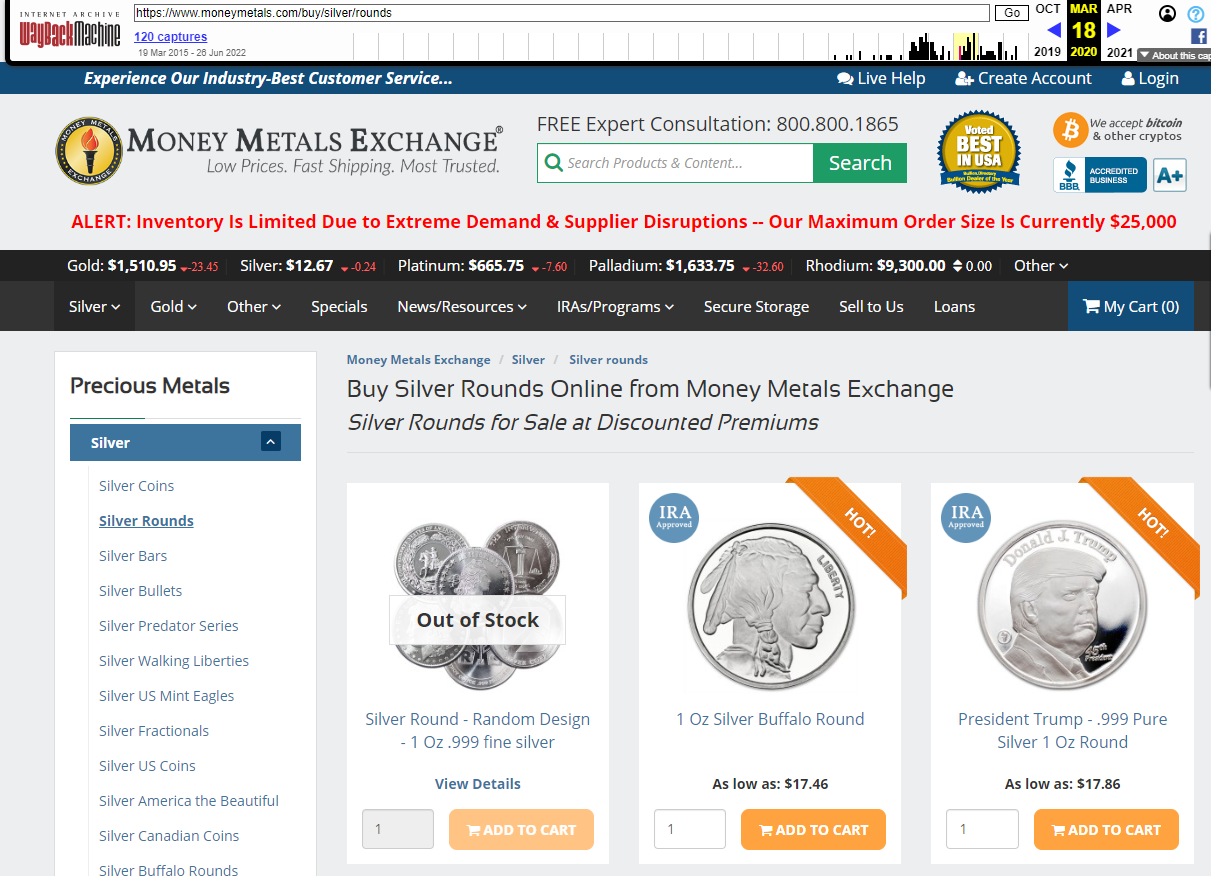

I noticed during the Coronavirus market Crash of March 2020, the spot price of silver was dropping to a low of $12 yet the physical stuff was all sold out. This was odd. If the price of silver is dropping in one area, shouldn't it drop everywhere else? Instead, the physical stuff was rising and selling out. (Wayback Machine link, Money Metals 2020-03)

(Wayback Machine link, Money Metals 2020-03)

Take a look above. It was March 2020. Spot price was at $12.67. Yet the lowest price for a buffalo round was $17.46. A high premium of $4.79 or 37.8%. Normally, premiums for rounds are between $1 - $3.5 and not 37.8%. Also take a look at the "Inventory is limited" alert.

Records of this phenomenon are pretty sparse. With the creation of this website, I am hoping to keep better track of the past.

Why Rocks?

If you consider investing in gold or silver, remember that they are inert rare rocks. They pay no dividends. They are supposed to be a hedge against crisis and inflation. You can see places with high inflation, such as Venezuela, that an ounce of silver does a good job retaining value when compared to the local currency. Priced in dollars, gold is slowly going up. Silver has been mostly flat for years. There is also an element of speculation regarding silver and its low price and the current "gold / silver" ratio. Normally around 15, the ratio is now 80. To go back to a ratio of 15. Either gold has to go down or silver has to go up.

There are commercial uses for all the precious metals such as catalytic converters in cars. The price of precious metals spiked up so much that it caused a large spike in catalytic converter thefts. Now, Platinum is $909 an ounce. Palladium is $2,177. Rhodium is $14,350 an ounce.(Catalytic crime spike in New York City)(Catalytic crime report in Los Angeles)

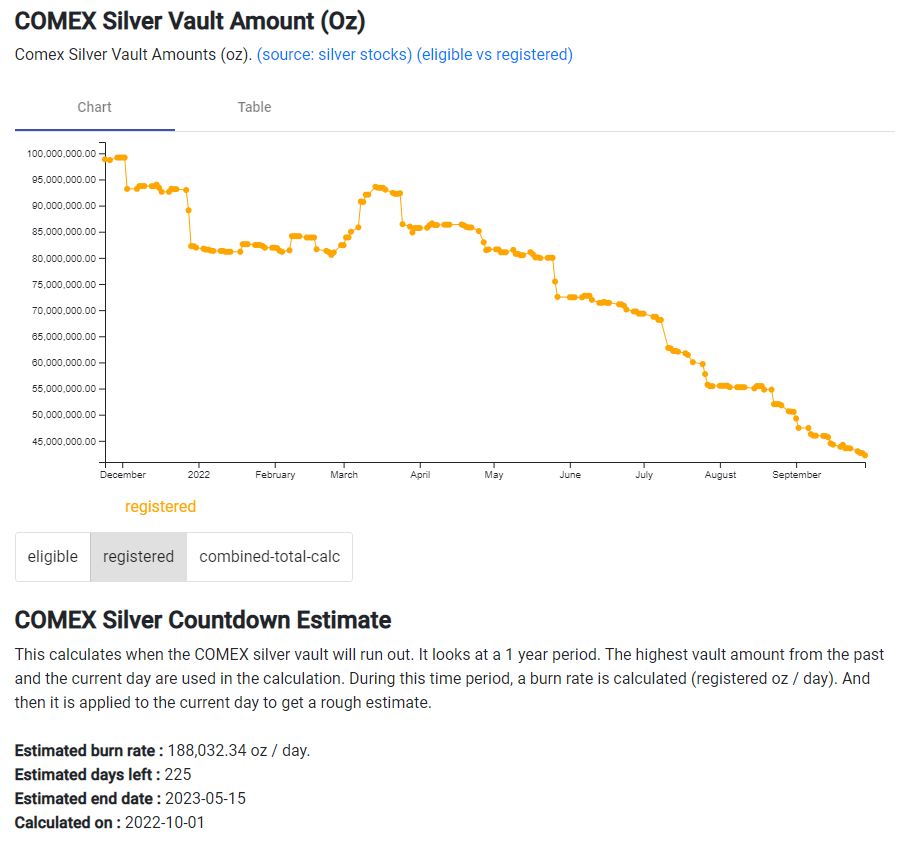

Charting Comex

A fun event on r/wallstreetbets was their discovery of the Gamestop (GME) short selling situation. In that situation, certain hedge funds were borrowing over 100% of available Gamestop shares for shorting. This is odd. How can someone borrow over 100% of something? Reddit bought out many of the shares preventing the borrowers from finding shares to give back. The borrowers had to really pay and thus the price of GME skyrocketed.(wiki)

I lurk r/wallstreetsilver(link).One of the things they talk about there from time to time, is the COMEX vault. They believe there is a similar situation happening there. Various explanations can be found in r/wallstreetsilver.

To track how much is in the vault, you have to download an excel sheet, parse numbers, and then make a chart. Normally, there is some random guy who does that. So for these people, I made some programs and this site to do all that.

If this is all true, I believe something strange may happen when the COMEX vault (registered or eligible) goes to 0. You may also see a further disconnect between the spot price and the physical price.

How I built this

Building this all was a bit of work. The most expensive part of this website is the ".io" domain.

- Hosting: AWS

- Compute: AWS Lambda and Java

- Database: AWS DynamoDB

- Front end: Javascript and Angular (I'll use React later)

- Other: AWS Api Gateway

- Drink: Water and G-fuel

Bookmark this

Be sure to bookmark and check out these numbers from time to time. Maybe something exciting will happen...